What Is The Income Tax Rate In Panama . If you earn between $0 to $11,000 annually, you will not pay income tax. Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. The territory does not have the indicated tax or requirement) np. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. Review the latest income tax rates, thresholds and personal allowances in panama which are used to calculate salary after tax when factoring in. Interest on panamanian government securities,. Here’s how much you’ll pay in income tax if you’re a panama resident: If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000.

from upstatetaxp.com

Na stands for not applicable (i.e. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. The territory does not have the indicated tax or requirement) np. Here’s how much you’ll pay in income tax if you’re a panama resident: Interest on panamanian government securities,. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. If you earn between $0 to $11,000 annually, you will not pay income tax. Review the latest income tax rates, thresholds and personal allowances in panama which are used to calculate salary after tax when factoring in.

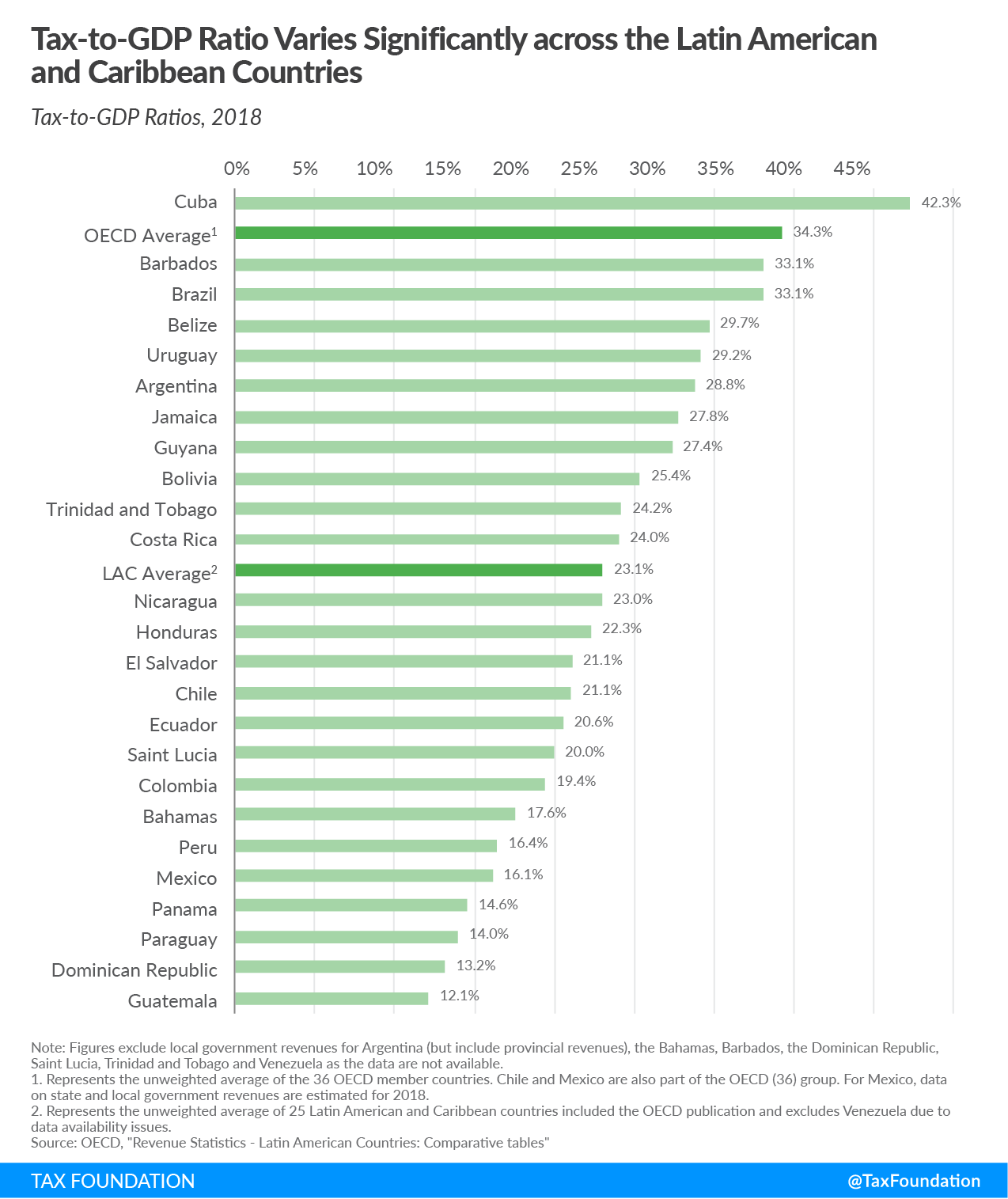

OECD Report Tax Revenue as Percent of GDP Below Average in Latin

What Is The Income Tax Rate In Panama If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Interest on panamanian government securities,. The territory does not have the indicated tax or requirement) np. Here’s how much you’ll pay in income tax if you’re a panama resident: Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. Review the latest income tax rates, thresholds and personal allowances in panama which are used to calculate salary after tax when factoring in. If you earn between $0 to $11,000 annually, you will not pay income tax.

From timesofindia.indiatimes.com

Budget 2023 Tax Slabs Savings Explained New tax regime vs Old What Is The Income Tax Rate In Panama If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Interest on panamanian government securities,. Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. The territory does not have the. What Is The Income Tax Rate In Panama.

From www.bizlatinhub.com

Business Accounting and Company Tax Requirements in Panama What Is The Income Tax Rate In Panama Interest on panamanian government securities,. If you earn between $0 to $11,000 annually, you will not pay income tax. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. The territory does not have the indicated tax or requirement) np. If you earn. What Is The Income Tax Rate In Panama.

From imagemart.jp

Offshore companies, panamanian documents, jornalistic inestigation What Is The Income Tax Rate In Panama If you earn between $0 to $11,000 annually, you will not pay income tax. Na stands for not applicable (i.e. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Here’s how much you’ll pay in income tax if you’re a panama resident: Personal income tax in panama is based on a sliding scale,. What Is The Income Tax Rate In Panama.

From wisevoter.com

States With No Tax 2023 Wisevoter What Is The Income Tax Rate In Panama If you earn between $0 to $11,000 annually, you will not pay income tax. Interest on panamanian government securities,. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Here’s how much you’ll pay in income tax if you’re a panama resident: The territory does not have the indicated tax or requirement) np. Personal. What Is The Income Tax Rate In Panama.

From panacrypto.com

Claves de Impuestos Inmobiliarios para Compradores en Panamá What Is The Income Tax Rate In Panama The territory does not have the indicated tax or requirement) np. Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000.. What Is The Income Tax Rate In Panama.

From www.richardcyoung.com

How High are Tax Rates in Your State? What Is The Income Tax Rate In Panama Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. The territory does not have the indicated tax or requirement) np. Interest on panamanian government securities,. Na stands for not applicable (i.e. If you earn between $0 to $11,000 annually, you will not. What Is The Income Tax Rate In Panama.

From upstatetaxp.com

OECD Report Tax Revenue as Percent of GDP Below Average in Latin What Is The Income Tax Rate In Panama Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. The territory does not have the indicated tax or requirement) np. If you earn between $0 to $11,000 annually, you will not pay income tax. Review the latest income tax rates, thresholds and. What Is The Income Tax Rate In Panama.

From mungfali.com

Tabla De Impuestos Mexico What Is The Income Tax Rate In Panama Na stands for not applicable (i.e. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Review the latest income tax rates, thresholds and personal allowances in panama which are used to calculate salary after tax when factoring in. Interest on panamanian government securities,. The territory does not have the indicated tax or requirement). What Is The Income Tax Rate In Panama.

From www.ndm.com.pa

Annual taxes in panama for expats What Is The Income Tax Rate In Panama Interest on panamanian government securities,. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. If you earn between $0 to $11,000 annually, you will not pay income tax. The territory does not have the indicated tax or requirement) np. Na stands for not applicable (i.e. Here’s how much you’ll pay in income tax. What Is The Income Tax Rate In Panama.

From expat-tations.com

Panama Property Taxes Exemptions, Rates, and Tips ExpatTations What Is The Income Tax Rate In Panama If you earn between $0 to $11,000 annually, you will not pay income tax. Here’s how much you’ll pay in income tax if you’re a panama resident: Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%.. What Is The Income Tax Rate In Panama.

From switch.payfit.com

tax — what's it all about? What Is The Income Tax Rate In Panama Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%.. What Is The Income Tax Rate In Panama.

From livingcost.org

Cost of Living in Panama prices in 10 cities compared What Is The Income Tax Rate In Panama Na stands for not applicable (i.e. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%.. What Is The Income Tax Rate In Panama.

From twitter.com

Advait Arora ᴡᴇᴀʟᴛʜ ᴇɴʀɪᴄʜ™ on Twitter tax rates worldwide What Is The Income Tax Rate In Panama Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. If you earn between $0 to $11,000 annually, you will not pay income tax. The territory does not have the indicated tax or requirement) np. If you earn between $11,001 and $50,000, you’re. What Is The Income Tax Rate In Panama.

From taxfoundation.org

Combined State and Federal Corporate Tax Rates in 2022 What Is The Income Tax Rate In Panama Na stands for not applicable (i.e. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. If you earn between $0 to $11,000 annually, you will not pay income tax. Interest on panamanian government securities,. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the. What Is The Income Tax Rate In Panama.

From printableformsfree.com

Tax Slab For Ay 2023 24 For Salaried Person New Regime What Is The Income Tax Rate In Panama The territory does not have the indicated tax or requirement) np. Interest on panamanian government securities,. Review the latest income tax rates, thresholds and personal allowances in panama which are used to calculate salary after tax when factoring in. Here’s how much you’ll pay in income tax if you’re a panama resident: Personal income tax in panama is based on. What Is The Income Tax Rate In Panama.

From www.marca.com

Tax payment Which states have no tax Marca What Is The Income Tax Rate In Panama The territory does not have the indicated tax or requirement) np. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. Review the latest income tax rates, thresholds and personal allowances in panama which are used to calculate salary after tax when factoring in. If you earn between $0 to $11,000 annually, you will. What Is The Income Tax Rate In Panama.

From usafacts.org

How much money does the government collect per person? What Is The Income Tax Rate In Panama Here’s how much you’ll pay in income tax if you’re a panama resident: Personal income tax in panama is based on a sliding scale, ranging from a minimum of 15% after the first us$11,000 to a maximum rate of 25%. Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first. What Is The Income Tax Rate In Panama.

From www.apteachers.in

Tax FY 202223 AY 202324 Tax Act IT FY 202223 New and What Is The Income Tax Rate In Panama Here’s how much you’ll pay in income tax if you’re a panama resident: Personal income tax in panama is based on a sliding scale, ranging from a minimum of 7 after the first $9,000, to a maximum rate of 27. If you earn between $11,001 and $50,000, you’re taxed at 15% on all income above $11,000. If you earn between. What Is The Income Tax Rate In Panama.